Sri Mulyani, Erlynda Kasim, Winwin Yadiati, Haryono Umar

Published : Opción, Año 35, Especial No.21 (2019): 323-338

ISSN 1012-1587/ISSNe: 2477-9385

Abstract

This study examines whether accounting information systems, internal audits, and corporate culture factors affect fraudulent financial reporting and the activities of corporate sustainability. This study was conducted in banks in Indonesia, using structural equation modelling (SEM). This model is based on a covariant known as Based Structural Equation Modeling (CBSEM). The results showed that accounting information systems, internal auditing, and corporate culture significantly affect financial reporting fraud. Similarly, Accounting and Corporate Culture Sustainability have a positive effect on companies. Fraudulent Financial Reporting also negatively affects corporate sustainability. In conclusion, this study fails to prove that Internal Auditing affects Corporate Sustainability.

Keywords: Corporate, sustainability, fraudulent, financial, reporting.

1. INTRODUCTION

The scarcity of energy, as well as increased customer awareness about social and environmental issues, has led to the growing issue today that is sustainability. Brundlant (1987) stated that humans have the ability to perform Sustainable Development to ensure the fulfillment of the needs of the present without compromising the ability of future generations to meet their needs. In this regard, companies have begun to implement Corporate Sustainability, and this practice is currently growing Wilson (2003) as an alternative to the traditional model (growth and profit maximization). In the paradigm of Corporate Sustainability, the company is not solely concerned with problems of growth and profitability, but they also pursue social objectives in Sustainability Development. These include environmental protection, economic development, and social balance. In line with its development, recently, the issue of Corporate Sustainability has become a topic of interest for research.

Until now, not all companies in Indonesia issued a Sustainability Report. Sustainability Reporting in Indonesia is still viewed as voluntary, whereas Kusumaatmadja (2015) suggests that Sustainability Reports should already be an obligation, due to their roles in protecting investors, particularly in relation to environmental and social risks. Making Corporate Sustainability Reports mandatory is meant to lessen the environmental problems that have occurred recently. Corporate Sustainability Reporting for the companies listed in the Indonesia Stock Exchange is voluntary.

In 2016, only 52 of approximately 527 (10%) companies published the Corporate Sustainability Report. Some social issues and environmental violations by companies are still prevalent in Indonesia, such as forest fires, toxic waste disposal, etc. For the banking sector in Indonesia, there are still violations of the Bank’s policy, giving credit to companies that violate the EIA (Environmental Impact Assessment).

In response, the Financial Services Authority (OJK) has recently established a rule requiring the financial industry to issue a Sustainable Financial Action Plan (RKAB) for banks in 2018.

The case of the Toshiba in Japan shows how Corporate Culture can cause Fraudulent Financial Reporting scandals; previous studies examined the relationship between the variables separately. Results of previous studies show that the relationship between variables is still diverse. As previous studies have not shown, this study observes these factors simultaneously and their influence in minimizing fraudulent financial reporting and the impact on sustainability reporting. As a novel strategy, this study aims to examine the factors that influence the occurrence of fraudulent financial reporting and its impact on the sustainability of the company.

2. LITERATURE REVIEW

Corporate Sustainability

Corporate Sustainability involves fulfilling the needs of the present while considering the ability of future generations to meet their needs. It includes the company’s operational impact on people’s lives where it operates, which includes environmental, social, and governance. Corporate Sustainability is evidence of involvement and the company’s attention to the social and environmental aspects of business operations and their interaction with stakeholders. Data shows that 93% of CEOs around the world see sustainability as critical to the future success of their business, while only 38% believe that they can accurately measure the value of their sustainability initiatives. Global Compact was established by the United Nations (UN) to initiate Corporate Sustainability globally. Corporate Sustainability is essential for businesses today because it correlates with the company’s success in the long term and ensures the market value in the community by making companies engage in sustainability. Corporate sustainability shows that businesses have principles, which strengthens the community, commits to leadership. It supports progress and local action.

Fraudulent Financial Reporting

Fraudulent financial reporting is the manipulation of financial statements conducted by the management to make the company appear more valuable (or to avoid taxes). This kind of report contains misleading financial statements. Some studies suggest that earnings management by the company is an action that leads to Financial Reporting Fraud or Fraudulent Financial Reporting. Irregularities can be labeled fraud if they include the following three elements: (1) conversion (deceive, manipulate, and others); (2) concealment (hiding), because fraud is a crime, then, of course, the actors do not want to be known by parties outside the group; (3) theft (taking wealth unlawfully), manipulation, fraud and engineering has been done surreptitiously and certainly done so that the companies can attract financial benefits unlawfully. Earnings management is done in a way to hide something with the intention of taking advantage unilaterally; it is therefore categorized as a fraud.

Accounting Information Systems

Accounting Information Systems are used to collect, process, and report information with respect to the financial aspects of the business events. Accounting Information Systems record and report business transactions and the flow of funds in the organization and then generate the Financial Statements. Accounting Information Systems’ Effectiveness are measured by the following dimensions: (1) system quality (Teru & Hla, 2015), (2) information quality (Delone & McLean, 2003), (3) user satisfaction (Nicolaou, 2000), and (4) internal control effectiveness (Mndzebele, 2013).

Internal auditing

Internal Auditing is an independent activity that provides objective assurance and consulting activities that add value and improve the operations of an organization. Internal audits help organizations achieve objectives by conducting a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. Moeller (2015) defines internal auditing in accordance with the IIA (Institute of Internal Audit). He defined it as an independent appraisal function within an organization created with the aim to assess and evaluate the activities of the organization, this study used dimensions: (1) perceived contribution auditees (Ameen et al., 2018), (2) management audit (Cascarino, 2007), and (3) the internal audit.

Corporate Culture

Corporate culture is a set of norms and values that are widely disseminated and strongly retained within an organization. Corporate culture is how things are done in an organization. It stimulates activity in the company, directs how employees think, act and feel. This is a set of assumptions that exist in daily activity behavior. Corporate culture is very important because it is a value that affects the behavior of both individuals who in turn have an impact on the company’s performance. The corporate culture in this study uses the following dimensions: (1) values and beliefs (Deloitte, 2015), (2) leadership (Deshpandé et al., 1993), and (3) employee integrity (Guiso et al, 2015).

3. METHODOLOGY

This study aims to examine the effect of the studied variables and hypotheses. Studies conducted in banks in Indonesian, with a sample size of 64, are based on returned questionnaires. The data used consists of primary and secondary data. The primary data used questionnaires to measure abstract variables of accounting information systems, internal audits, and corporate culture. The measurement technique used to transform qualitative data from the questionnaires into a measure of quantitative data was the Summated Rating Method: Likert Scale.

4. EMPIRICAL RESULTS

Validity test results of Accounting Information Systems Effectiveness variable (X1), Internal Audit (X2), and Corporate Culture (X3) show all the item variables had a value count > 0.3. All items are valid variables, and the questionnaires already have a good degree of validity. This means that the questionnaires measure the Effectiveness of Accounting Information Systems (X1), Implementation of Internal Audit (X2), and Corporate Culture (X3) researched.

Table 1: Questionnaire Reliability Test Results

| Variables | Coefficient reliability | Value critical | Conclus ion |

| Effectiveness of Accounting Information Systems (X1) | 0.878 | 0.7 | reliable |

| Implementation of Internal Audit (X2) | .807 | 0.7 | reliable |

| Company culture (X3) | .869 | 0.7 | reliable |

(Source: Data Processing)

Table 1 shows that the value of Cronbach’s Alpha for each variable is greater than the critical value of 0.70. Results of these tests showed that the three research variables’ measuring devices were reliable. It can be concluded that the questionnaires used to measure Effectiveness of Accounting Information Systems (X1), Implementation of Internal Audit (X2), and the Company culture (X3) are reliable.

Structural Model Estimation Results (Structural Equation Modeling/ SEM)

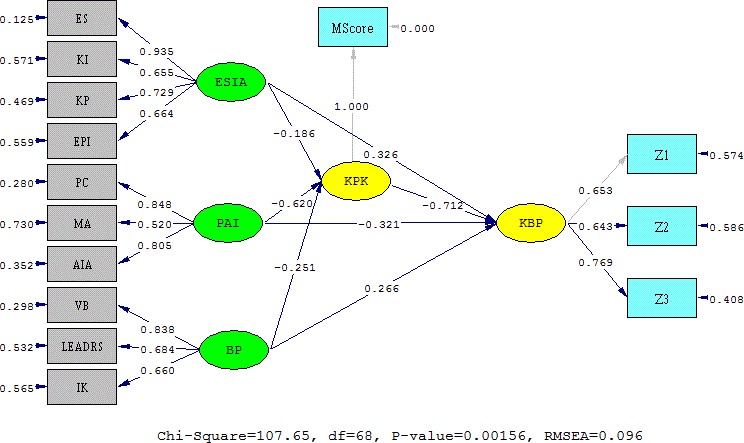

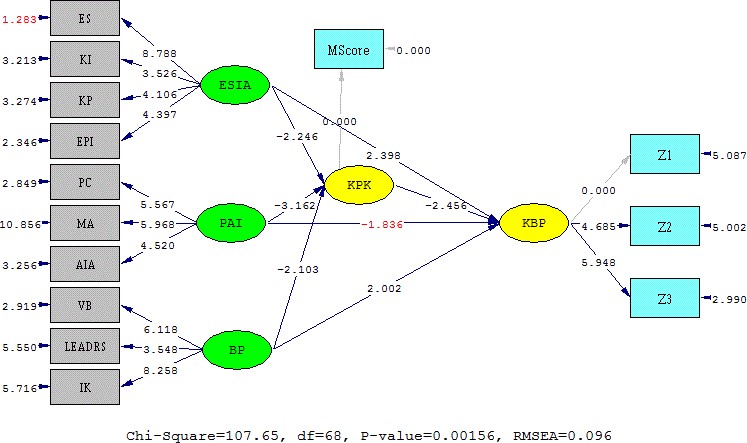

Structural Equation Modeling (SEM) is an approach model. The variable Effectiveness of Accounting Information System consists of four dimensions as an observed variable; the variable Internal Audit consists of three dimensions as an observed variable; the variable Culture Company consists of three dimensions as an observed variable; the variable Fraudulent Financial Reporting consists of one indicator as an observed variable; and the variable Corporate Sustainability consists of three dimensions as an observed variable (Figure 1, 2).

Figure 1: Loading Value Factor

Figure 2: Structural Model Full Model

Table 2: Structural Model Calculation Results Effect of Accounting Information Systems Effectiveness (x1), Of Internal Audit (x2) And Corporate Culture (x3) Of the Financial Reporting Fraud (h1)

| Latent Variables Exogenous | Coefficient Lane | t | tcritical | R2 | Error variance |

| Effectiveness of Information

Systems accounting (x1) |

-0.186 | -2.246 | 1.96 | 0.802 | 0.198 |

| Implementation of Internal Audit

(x2) |

-0.620 | -3.162 | 1.96 | ||

| Company culture (x3) | -0.251 | -2.103 | 1.96 |

(Source: Data Processing)

Table 2 shows the results of calculations for the effect of structural equation Effectiveness of Accounting Information Systems, Internal Audit, and Corporate Culture on Financial Reporting Fraud as follows:

h1 = -0.186 x1 – 0.620 x2 – 0.251 x3 + 0.198.

From the results of statistical testing, results of hypothesis testing can be divided into each influence of the variables Effectiveness of Accounting Information Systems, Internal Audit, and Corporate Culture on Financial Reporting Fraud. Each of these variables has a tcount smaller than negative tcritical, which is smaller than (t < -1.96). Therefore, the decision is to reject H0. We can conclude that the statistical test results showed the following:

- Hypothesis 1: Effectiveness of Accounting Information Systems has a negative effect on Financial Reporting

- Hypothesis 2: Implementation of Internal Audit has a negative effect on Financial Reporting

- Hypothesis 3: Corporate culture has a negative effect on Financial Reporting

Table 3: Structural Model Calculation Results on the Effects of Accounting Information Systems’ Effectiveness (x1), Of Internal Audit (x2) And Corporate Culture (x3) as well as the Financial Reporting Fraud (h1) On Corporate Sustainability (h2)

| Variables latent Exogenous | Coeffic

ient lane |

t | criti cal | 2 | Error variance |

| Effectiveness of Accounting

Information Systems (x1) |

.326 | 2.398 | .96 | 0,7

47 |

0,253

|

| Implementation of Internal Audit (x2) | -0.321 | * – 1.836 | .96 | ||

| Company culture (x3) | 0,266 | 2,002 | .96 | ||

| Fraudulent Financial Reporting (h1) | -0.712 | ** – 2,456 | .96 |

(Source: Data Processing)

* No significant effect / **significant negative effect

Table 3 is the calculation of the structural equation for the Effectiveness of Accounting Information Systems, Internal Audit, and Corporate Culture, and Fraudulent Financial Reporting on the Corporate Sustainability is as follows:

h2 = 0.326 x1 – 0.321 x2 + 0.266x3 – 0.712 h1 + 0.253. (1)

5. CONCLUSION

From the statistical tests results, we have shown that effective Accounting Information Systems, Implementation of Internal Auditing, and Corporate Culture have negative effects on financial reporting fraud. This shows that the more effective the Accounting Information System, the better the Implementation of Internal Audit and better corporate culture. This will reduce the likelihood of Fraudulent Financial Reporting. An effective information system contains elements of adequate internal controls, such as segregation of duties, proper authorization, and balance checks periodically so as to reduce the risk of fraud. Good Accounting Information Systems has standard continuous assurance. Likewise, internal auditing is expected to identify the possibility of fraud. The data outliers, suspicious transactions, unusual balance forecasts, and others can be identified by the internal audit to prevent fraud. A strong corporate culture is necessary to prevent abuses and fraud committed by leadership. A poor ethical climate can also cause offense.

A change of company paradigm, from maximizing profits to sustainability, requires a cultural change within the organization. Companies need new values of corporate culture oriented toward sustainability as the aforementioned results have shown. Future research is expected to discover specifically what kind of corporate culture can support sustainable activities and which aspects should take precedencies, such as staff, efficiency, environmental friendliness, and the involvement of stakeholders. Fraudulent Financial Reporting has significant negative effects on Corporate Sustainability. Companies that commit Fraudulent Financial Reporting experience worse sustainability activities. The results of this study explain that the companies that avoid Fraudulent Financial Reporting will be actively involved in sustainable activities. This can be explained as moral responsibilities where a company does not perform fraudulent activities.

REFERENCES

AMEEN, A., AHMED, M., & HAFEZ, M. 2018. The Impact of

Management Accounting and How It Can Be Implemented into the Organizational Culture. Dutch Journal of Finance and Management. Vol. 2, No 1: 02. Netherlands.

BRUNDLANT, H. 1987. Report of the World Commission on Environment and Development: Our Common Future. Retrieved from un-documents.net: http://www.un- documents.net/our-common-future.pdf. Netherlands.

CASCARINO, R. 2007. Internal auditing: an integrated approach. In R. Cascarino, Internal auditing: an integrated approach. Juta and Company Ltd. South Africa.

DELOITTE, K. 2015. Corporate culture: The second ingredient in a world-class ethics and compliance program. Retrieved from Deloitte:

https://www2.deloitte.com/content/dam/Deloitte/us/Documen ts/risk/us-aers-corporate-culture-112514.pdf. South Africa.

DELONE, W., & MCLEAN, R. 2003. The delone and McLean model of information systems success: a ten-year update. Journal of management information systems. pp. 9-30. UK.

DESHPANDÉ, R., FARLEY, J., & WEBSTER, J. 1993.

Corporate culture, customer orientation, and innovativeness in Japanese firms: a quadrad analysis. The journal of Marketing. Vol. 57, No 1: 23-37. USA.

GUISO, L., SAPIENZA, P., & ZINGALES, L. 2015. The value of

corporate culture. Journal of Financial Economics. Vol. 117, No 1: 60-76. Netherlands.

KUSUMAATMADJA, S. 2015, December 18. Important, Company Sustainability Report as Obligation. Retrieved from Kompas:

http://bisniskeuangan.kompas.com/read/2015/12/18/1554559 26/Penting.Laporan.Keberlanjutan.Perusahaan.sebagai.Kewa jiban. Indonesia.

MNDZEBELE, N. 2013. The usage of accounting information systems for effective internal controls in the Hotels. International Journal of Advanced Computer Technology. Vol. 2, No 5: 1-3. India.

MOELLER, R. 2015. Brink’s Modern Internal Auditing: A Common Body of Knowledge. John Wiley & Sons. USA.

NICOLAOU, A. 2000. A contingency model of perceived effectiveness in accounting information systems: Organizational coordination and control effects. International Journal of Accounting Information Systems. Vol. 1, No 2: 91-105. Netherlands.

TERU, S., & HLA, D. 2015. Appraisal of Accounting Information System and Internal Control Frameworks. International Journal of Scientific and Research Publications. Netherlands.

WILSON, M. 2003. What is it and where does it come from?

Ivey Business Journal. China.