Uskara, A.M ; Mulyani, Sri ; Akbar, Bahrullah; Sudrajat

Opción, Año 35, No.89 (2019): 195-214

ISSN 1012-1587/ISSNe: 2477-9385

Abstract

The present study aims to proof the effect(s) of the internal control system’s effectiveness on village government’s performance, measured through levels of fraudulent activities in village fund management. Data was analyzed using Structural Equation Model (SEM)-LISREL method. The result shows that the lower the internal control effectiveness is, the higher level of fraudulent activities in village fund management are; which may lead to low performance of village government. In conclusion, an effective internal control system plays a crucial role in reducing frauds in village fund management.

Keyword: Internal, control system, fraud, performance.

1. INTRODUCTION

Decentralization practice in Indonesia begins when the regulation package, which contains Law No. 17/2003 on State Finance, Law No.32/2004 on Regional Government, and Law No.33/2004 on Balancing Central and Regional Finance, was passed with positive effects for regional government’s autonomy. The decentralization brings its own challenges and opportunities to regional governments to operate effectively, efficiently, and economically. Regions with high Own-Source Revenue are expected to spend their income wisely to improve public services quality in the region. On the other hand, regions with low Own-Source Revenue should find alternative sources of income to maintain their public services. The discrepancy in regional potentials and natural resources has led to the central government’s transferring funds to each region. One of such funding efforts was Village Fund Allocation.

By 2017, there were a total of 74,954 villages all over the nation receiving a total of IDR 60 Billion Village Fund Allocation. This fund was intended to solve the problems of poverty, distribute equal development, and improve village governments’ performance. Carton & Hofer (2006) argued that performance was a means to create value for an organization. In a similar note, Kurt & Van (2004) defined organizational performance as a value that an organization could create using productive assets relative to the value expected by the capital owners. In Indonesia, there has been a common phenomenon of fraudulent use or management of the village fund, which affects the village government’s performance.

Carton & Hofer (2006) noted that in 2017, there were at least 671 problems pertaining to fraudulent use of village fund that the Ministry of Village Administration received. Lane (2010) conducted a study in London cities by interviewing key individuals in various organizations, and the results showed that fraud was a major factor in low performance. The results of another study showed that high rates of deviation or fraud had a negative effect on organizational performance. Cohen et al. (2004) stated that one of the causes of frauds and accounting scandals was the weak Corporate Governance which affected organizational performance. Cohen et al. (2004) found that stock prices (company performance) were responded negatively by investors in Malaysia if there was a deviation or fraud in the company.

In addition, Gupta & Narolia (2005) found that low performance in an organization was caused by various leaks occurring in the company, one of which was indicated by low employee competency. A factor that can decrease the level of organizational fraud is an internal control system. The internal control system is a policy and procedure designed to provide reasonable assurance to management that organizational goals and objectives are achievable (Arens et al., 2001). An audit on village fund conducted by Indonesia’s Financial Audit Board for the first term of 2015-2016 fiscal year found the following real conditions pertaining to Village Fund management:

(a) There had not been any written regulation concerning sanctions for village chief who conducted fraudulent activities, and

(b) Financial management and use were not accountable. These two factors had caused a high level of frauds in Village Fund management. Implementing ongoing internal control might solve this problem.

Meanwhile, Cohen et al. (2004) argued that an effective internal audit could reduce the level of frauds in public organizations. Rezaee (2006) found that internal control implemented by the internal auditor would prevent fraudulent activities. Ray (1999) also found that internal control procedures were effective for the early detection of frauds. Fund transfer from the central government to regional governments in Indonesia was initiated in 2015. Various researches on this subject had found a phenomenon of frauds and deviations. The present study is an important contribution to the effort of making the Indonesian government’s program a success.

2. LITERATURE REVIEW

COSO (2013) defined internal control as a process effected by an entity’s board of directors, management, and other personnel, designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting, and compliance. Meanwhile, Moeller (2010) argued that internal control was a process in which a company and its unit of operation attempted to minimize the possibility of an accounting error, deviation, and illegal activities. The present study implements several dimensions of internal control developed by Arens et al. (2001), Moeller (2010) and the Republic of Indonesia’s Government’s Regulation No. 60/2008. The dimensions are control environment, risk assessment, control activities, information and communication, and monitoring.

Performance is a measure of productivity in using output and input, i.e. all goods and services as well as resources utilized in achieving organizational objectives. Therefore, every improvement in productivity is also an improvement in performance. In line with this, Arens et al. (2001) noted that performance had to do with organizational efficiency. Fraud is a deliberate act to cheat or deceive, a trick or dishonest way to take or eliminate money, property, or legitimate rights of another person due to an action or the fatal result of that action (Arens et al., 2001). Frauds can be detected through various direct phenomena such as lifestyle changes, suspicious documentation, or customers’ complaints (Moeller, 2010). Rezaee (2006) categorized frauds, based on the perpetrator, into management fraud and employee fraud. Meanwhile, Belkaoui (2012) noted that there were four types of frauds commonly found in an organization, i.e. corporate fraud, financial reporting fraud, management fraud, and audit failure. The present study utilizes three dimensions of fraud measurements: financial reporting fraud, asset fraud, and corruption (Arens et al., 2001).

3. RESEARCH HYPOTHESIS

Akisik & Graham (2017) conducted a study in 132 schools in the USA and found that in organizations with weak internal control, frauds often occurred. In addition, Doyle & Mcvay (2007) found that incidents of fraud would occur in an organization if internal control were not present since the early process of selecting and contracting administrative resources the company would use. In this case, the dimensions of control activities, monitoring, and control environment should be applied. Altamuro & Baetty (2010) found that internal control system was significantly able to decrease the level of frauds in a company.

Rezaee (2006) argued that prevention and detection of frauds performed by internal auditors contributed in organization’s effectiveness measurement, providing inputs for continuous performance improvement, and monitoring of financial report’s quality, integrity, and reliability. This is in line with Rezaee (2006) who noted that internal control practices and internal auditor’s effectiveness could reduce the possibility of financial report frauds. Based on these facts, the following hypothesis is formulated (Yang et al., 2019):

H1: Effective internal control system will minimize fraudulent practices in Village Fund management.

Gupta & Narolia (2005) conducted their research in banks and financial institutions in India and found that frauds in those institutions were caused by the ineffective implementation of due diligence and the lack of executive professionalism, leading to reduced performance. Lane (2010) found that incompetence and ineffectiveness of internal controls carried out by the company’s internal audit contributed to various frauds, which resulted in a decrease in performance. Meanwhile, Agrawal et al. (1999) found that companies accused of frauds generally had high turnover rates of senior managers. This was done in the hope that the company could immediately get out of the crisis caused by the deteriorating performance of the company. Based on these facts, the following hypothesis is formulated:

H2: Level of frauds has an adverse effect on the village government’s performance.

Moeller (2010) noted that internal control was a process implemented by management, designed to provide reasonable assurance concerning the reliability of financial report and operational information that represented the performance the company might achieve. This statement was supported by Hayes et al. (2005) who stated that one of the functions of internal control was to ensure that the company could operate well and achieve high performance. Zahra et al. (2015) found that there was a strong correlation between internal control and the organization’s financial performance. Based on these theories and previous studies, the following hypothesis is formulated:

H3: Effective internal control system will improve village government’s performance.

4. RESEARCH METHODOLOGY

The sample in this study, selected through purposive sampling technique, consisted of 346 village governments, representing the whole population of village governments in Indonesia. Questionnaires were distributed to 1,384 respondents, i.e. managerial level personnel in village government. Data was analyzed using Structural Equational Model-Lisrel.

5. FINDINGS

Questionnaire distribution and data collection took nine months. One of the causes for this was the difficult demographic condition; it was hard to access most of the villages due to the long distance between them. Another difficulty in collecting data for this study was respondents’ low level of comprehension of the questionnaire items. The researcher had to accompany the respondents and provide an explanation concerning the items whenever necessary. Of the 1,570 questionnaires distributed, only 1,384 questionnaires were collected and processed (88% response rate). The respondents’ demographics in this study were distributed based on gender, age, education and work experience. Table 1 shows the respondents’ demographics.

Table 1: Respondents’ Demography

|

Characteristic |

Frequency |

Percentage |

| Sex | ||

| Male | 1,134 | 81.9% |

| Female | 250 | 18.1% |

| Education Level | ||

| High School | 759 | 54.8% |

| Associate Degree 1 | 3 | 0.2% |

| Associate Degree 3 | 95 | 6.9% |

| Bachelor Degree | 527 | 38.1% |

| Work Experience |

| < 1 year | 10 | 0.7% |

| 1 – 5 year | 1,046 | 75.6% |

| 6 – 10 year | 213 | 15.4% |

| 11 – 15 year | 88 | 6.4% |

| 16 – 20 year | 16 | 1.2% |

| > 20 year | 11 | 0.8% |

The questionnaires’ validity and reliability, which is a proxy of the indicators, were explained by examining the relationship between indicators and variables. The test results are shown in table 2.

Table 2: Validity and Reliability

| Laten

Variable |

Indicator | λ | λ2 | e | CR | VE | Resu

lt |

| Internal Control System’s Effectiveness (IC) | IC1 | 0,940 | 0,884 | 0,116 | 0,958 | 0,821 | Rel iab el |

| IC2 | 0,811 | 0,658 | 0,342 | ||||

| IC3 | 0,924 | 0,854 | 0,146 | ||||

| IC4 | 0,887 | 0,787 | 0,213 | ||||

| IC5 | 0,962 | 0,925 | 0,075 | ||||

| Levels Of Fraudulent Activities In Village Fund Management

(FRAUD) |

FRAUD1 | 0,752 | 0,566 | 0,434 | 0,944 | 0,851 | Rel iab el |

| FRAUD2 | 0,998 | 0,996 | 0,004 | ||||

| FRAUD3 | 0,995 | 0,990 | 0,010 | ||||

| Village | PERF1 | 0,993 | 0,986 | 0,014 | 0,996 | 0,987 | Rel

iab |

| Government’s

Performance (PERF) |

PERF2 | 0,991 | 0,982 | 0,018 | |||

| PERF3 | 0,996 | 0,992 | 0,008 |

In Table 2, it can be seen that all indicators have a standard loading factor (SFL) > 0.50. This value is significant, indicating that all indicators are valid. Reliability is measured using Construal Reliability (CR) with a value of more than 0.70; which means that the indicators are reliable, and the Variance Extracted (VE) score above 0.5; which indicates that the research instrument is valid and reliable.

5.1. Structural Model Testing

Before testing the hypotheses, a research model should be tested to determine its Goodness of Fit Index (GOFI). Table 3 shows the results of GOFI testing in this study. Based on the results it is known that the values of GFI, NNFI, NFI, AGFI, RFI, IFI, and CFI are higher than 0.90 which means that the model to be tested is a good fit so that the research model can be accepted and the study can proceed to the hypothesis testing stage.

Table 3: Goodness of Fit Index-Full Model

| Indeks fit | Result | Recommended

Value |

Evaluation

Model |

| Chi-Square | 91,608 | ||

| Probabilitas | 0,000 | > 0,05 |

| Chi-

Square/DF |

2,476 | < 2 | Marginal fit |

| RMSEA | 0,065 | < 0,08 | Good fit |

| GFI | 0,954 | > 0,90 | Good fit |

| NNFI | 0,989 | > 0,90 | Good fit |

| NFI | 0,987 | > 0,90 | Good fit |

| AGFI | 0,918 | > 0,90 | Good fit |

| RFI | 0,981 | > 0,90 | Good fit |

| IFI | 0,992 | > 0,90 | Good fit |

| CFI | 0,992 | > 0,90 | Good fit |

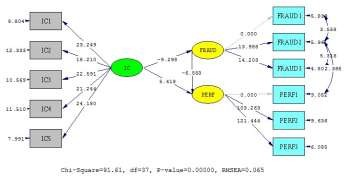

The hypotheses are tested using Structural Equation Model that tests the statistical significance of the coefficients based on a standard significance level (typically α = 0.05). The result of hypotheses and path coefficients tests is shown in Figure 1 and summarized in Table 4 (Present significance level).

Figure 1: Path Coefficients Tests (Full Model)

Table 4: Hypothesis Test Result

| Hypothesis | Path

Coefficient |

t-

Statistic |

Significant | Coclution |

| IC —->

FRAUD |

0,545 | -9,298 ≤

1,65 |

Negative | Hypothesis

is Accepted |

| FRAUD ->

PERF |

0,389 | -6553 ≤

1,65 |

Negative | Hypothesis

is Accepted |

| IC —->

PERF |

0,305 | 5,418 ≥

1,65 |

Positive | Hypothesis

is Accepted |

The low level of effectiveness in internal control (IC) leads to an increase in fraud practices (FRAUD) in village government offices. The test results in table 4 show that this hypothesis is accepted. The path coefficient value of 0.545 means that IC has an effect of 54.5% on the prevention of FRAUD, while the rest is affected by other factors (Indriastuti, 2019). Fraud practice (FRAUD) has a negative effect on village government performance (PERF). The test results in table 4 show the hypothesis is accepted. The coefficient of

0.389 means that FRAUD affects PERF by 38.9%, while the remaining 62.1% is affected by other factors. High effectiveness of the internal control system (IC) will improve the village government’s performance (PERF). The test results in table 4 show that this hypothesis is accepted. The path coefficient value of 0.305 indicates that IC has 30.5% effect on PERF, while the rest is influenced by other factors.

To prove that FRAUD is an intervening variable, the results of direct and indirect effects tests are presented in the following Table 5:

Table 5: Intervening Variable Test Result

| Hubungan | Direct | Indirect | Total | |||

| Koeficie

n |

thitung | Koeficie

n |

thitung | Koefici

en |

thitung | |

| IC →

FRAUD |

-0,545 | –

9,298 |

– | – | -0,545 | –

9,298 |

| FRAUD

→ PERF |

-0,389 | –

6,553 |

– | – | -0,389 | –

6,553 |

| IC →

PERF |

0,305 | 5,418 | 0,212 | 5,521 | 0,517 | 10,137 |

IC path coefficient has 0.305 direct effects on PERF and 0.212 indirect effects through FRAUD. Therefore, the total effect of IC on PERF through FRAUD is 0.517; higher than the direct effect of 0.305. This shows that FRAUD variable has a positive contribution in mediating IC correlation, which proves that FRAUD is an intervening variable.

6. DISCUSSION

The effect of internal control system implementation on the level of fraud in village fund management is in line with Douglas & Schwartz’s study (2001) that found that ongoing implementation of internal control effectively decreased the level of frauds in a company. Akisik & Graham (2017) conducted a study in 132 schools in the USA and found that in organizations with weak internal control, frauds often occurred. Furthermore, Altamuro & Baetty (2010) found that internal control system was significantly able to decrease the level of frauds in a company. In addition, Doyle & Mcvay, (2007) found that incidents of fraud would occur in an organization if internal control were not present since the early process of selecting and contracting administrative resources the company would use. In this case, the dimensions of control activities, monitoring, and control environment should be applied (Fateminasab, 2014: Radhy, 2019).

The findings of the present study support the contingency theory, in that situational factors affected the efforts to reduce frauds in village fund management. One way to do this is by implementing the internal control system. Internal control implementation is mandatory for all government institutions and agencies, from the central government, regional governments (province and city/regency), to the lowest level of government, i.e. the village government. The issuance of Government’s Regulation No. 60/2008 on Governmental Internal Control System supported this. However, the facts in the field showed weak internal control practices in village government, as suggested by various studies and external audit that could not be followed up. This proves that the weak internal control system increases the levels and frequencies of fraudulent activities in village fund management (Sears, 2018).

Frauds in village fund management also affected performance. The findings of this study and previous studies show that there are many cases of frauds perpetrated by village government officials or regional government personnel. There were many cases of (suspected) fraud and corruption involving government officials. This indicates that low performance of village government might be due to ineffective management and frauds; which in turn indicate that the government’s policies on village fund are ineffective and inefficient. The high level of fraud has led to the non-increasing prosperity of rural communities, quickly deteriorated infrastructure due to the low quality of materials used, and the increasingly high level of poverty. The findings of this study also show that village funds allocated by the central government still do not provide maximum benefits to the people because of fraud conducted by village government employees (Soo et al., 2019).

7. CONCLUSION

The weak internal control system will cause an increase in fraudulent activities in village fund management. This is because adequate risk assessment, a clear distinction of functions, and accurate and timely financial reporting are not present. The effective internal control system is implemented to ensure effective and efficient operation in an organization. In the scope of this study, it means securing village assets, ensuring reliable financial report, and compliance with existing laws and regulations. This, in turn, will ensure the success of the village fund program by preventing and minimizing frauds in village fund management. This finding supports a previous study by (Rezaee, 2006).

Frauds in village fund management are performed through manipulating financial report, asset frauds, and corruption. This is evident in many problems in village government offices that have not been resolved. It means that the objectives of village funds allocations have not been optimally achieved. This finding supports the previous study by Costello & Moerman (2010), which found that internal control had a positive effect on overall company performance. The findings of this study indicate that an effective internal control system plays a crucial role in reducing frauds in village fund management. Improving the effectiveness of the internal control system through the control environment, risk assessment, control activities, information and communication, and monitoring is expected to reduce frauds in village fund management, which will improve performance. This will lead to the successful implementation of government efforts to solve social and economic discrepancies and other problems pertaining to poverty, bad infrastructure, and low prosperity in villages in the nation.

REFERENCES

AGRAWAL, A., & CHADHA, S. 1999. Corporate governance and accounting scandals. Journal of Law and Economics. Vol. 48, No 2: 371-406. USA.

AKISIK, O., & GRAHAM, G. 2017. The Impact of Corporate Social Responsibility and Internal Controls on Stakeholders’ View of the Firm and Financial Performance. Sustainability Accounting, Management and Policy Journal. Vol. 8, No 3. Doi: 10.1108/SAMPJ-06-2015-0044. UK.

ALTAMURO, J., & BEATTY, A. 2010. How does internal control regulation affect financial reporting? Journal of Accounting and Economics. Netherlands.

ARENS, A., ALVIN, J., ELDER, S., & BEASLEY, L. 2001. Auditing and Assurance Service. Prentice Hall. USA.

BELKAOUI, A. 2012. Accounting Theory. Thomson Learning. London. UK.

CARTON, B., & HOFER, W. 2006. Measuring Organizational Performance. Edward Elgar Publishing Limited. UK.

COHEN, J., KRISHNAMOORTHY, G., & WRIGHT, A. 2004. The corporate governance mosaic and financial reporting quality. Journal of accounting literature. pp. 87-152. Netherlands.

COSO, L. 2013. Internal Control Integrated Framework. American Institute of Certified Public Accountant. USA.

COSTELLO, A., & MOERMAN, R. 2010. The impact of financial reporting quality on debt contracting. Evidence from internal control weakness reports. USA.

DOUGLAS, R., & SCHWARDZ, B. 2001. The effect of organization culture and ethical orientation on Accountants ethical jugdement. Journal of Business ethics. Vol. 34, pp. 101-121. Germany.

DOYLE, J., & MCVAY, K. 2007. Determinants of weaknesses in internal control over financial reporting. Journal of Accounting and Economics. Elsevier. Netherlands.

GUPTA, S., & NAROLIA, V. 2005. Role of Competency Mapping In Indian Companies. International Research Journal of Human Resource and Social Science. Vol. 2, No 10. India.

HAYES, R., DASSEN, R., SCHILDER, A., & WALLAGE, P. 2005.

Principle of auditing. An introduction to international standard on auditing. 2nd Ed. Prentice Hall. USA.

INDRIASTUTI, H. 2019. Entrepreneurial inattentiveness, relational capabilities and value co-creation to enhance marketing performance. Giap journals. Vol 7. No 3. India.

FATEMINASAB, A. (2014). Investigating the challenges and barriers of convergence between Iran and republic of Azerbaijan, UCT Journal of Social Sciences and Humanities Research, 2(1): 18-24.

KURT, V., & VAN, D. 2004. Integrated Performance Management A Guide to Strategy Implementation. SAGE Publication London. USA.

LANE, J. 2010. Management and public organization: The principal-agent framework. University of Geneva and National University of Singapore. Working paper. USA.

Moeller, R. 2010. Executive’s Guide to COSO Internal Controls Understanding and Implementing the New Framework. John Wiley & Sons, Inc. USA.

RAY, B. 1999. Good governance, administrative reform and socioeconomic realities A South Pacific perspective. International Journal of Social Economics. Vol. 26, No 1/2/3: 354-369. UK.

REZAEE, Z. 2006. Causes, consequences, and deterence of financial statement fraud. Elsevier Science Ltd. All rights reserved.doi:10.1016/S1045-2354(03)00072-8. Netherlands.

SEARS, R. 2018. The Implications of a Pacing Guide on the Development of Students Ability to Prove in Geometry. International Electronic Journal of Mathematics Education. Vol 13. No 3. pp. 171-183. UK.

SOO, M., SHELBY, R., & JOHNSON, K. 2019. Optimizing the

patient experience during breast biopsy. Journal of Breast Imaging. wbz001, https://doi.org/10.1093/jbi/wbz001. UK.

YANG, Y., PAN, T., & ZHANG, J. 2019. Global optimization of Norris derivative filtering with application for near-infrared analysis of serum urea nitrogen. Scientific Research Publishing. Vol 10. No 5. China.

ZAHRA, L., ABDULRAHMAN, G., & BAKHSHAYESH, E. 2015.

Internal Control Weakness and Accruals Quality in Companies Listed on Tehran Stock Exchange. Procedia – Social and Behavioral Sciences. Vol. 207. Pp. 454 – 461. Netherlands.

RADHY, Z. H. (2019). Application of Multiply Regression Linear Model and New Technology Method in Estimating Learning and Education of Students. International Electronic Journal of Mathematics Education, 14(1), 87-90.

https://doi.org/10.12973/iejme/3978